How To Switch Checking Accounts

Think It's difficult to Switch Checking Accounts, it's not!

I put together these steps on how to switch checking accounts.

It may seem intimidating to switch checking accounts and it will take some time, but by finding a checking account with lower fees, that pays interest and has no ATM fees can help save and even make a lot more money per year. To help people switch, I put together my plan on how to switch checking accounts.

Steps to Switch Checking Accounts

- The first step to switching checking accounts is developing a list of needs. Mine included high yields, no fees (including reimbursing atm charges), no minimum balance, free checks, free bill pay, online access and mobile deposits. Some people may feel they need to go into a bank. That's fine, although it will likely cost a bit more. After researching several checking account options I went with Charles Schwab as the best checking account.

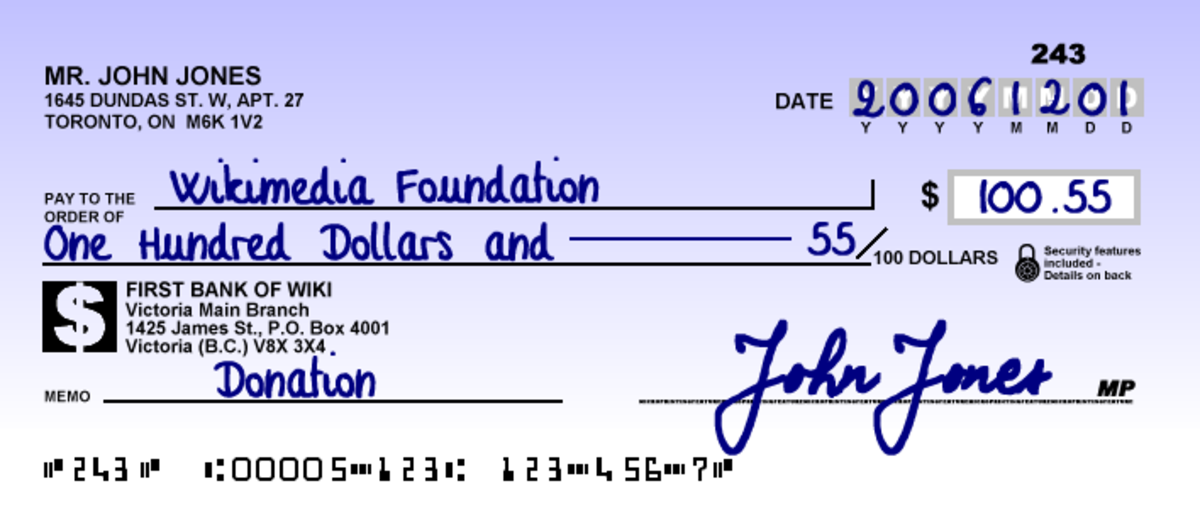

- The next step is to open the account. This usually involves printing out some forms. Filling them out and mailing them in to the bank or going to a local branch. They'll collect a social security number, and a drivers license number as well as other personal information.

- Once the account is open, activate all the services. It takes a few days to turn on mobile deposits with some banks and it can take up to seven days to get a set of checks. Do these things right away.

- The next step is switching things to the new account that are on direct deposit. This includes pay checks and other services that deposit money into your account. Figure out the date that the deposits will switch to the new account. This date is critical to the switch.

- Make a list of all bills that are directly debited from your current checking account. Go to the website for these and update or print out the forms to switch to the new checking account. In my example, I pay my car payment, and insurance via direct debit. I filled out the forms that include my routing number and account of my new checking account. I make sure the switch for these bills happens after my direct deposit switch date so there is money in the account to cover the bills.

- Go to the online bill pay section of the current account and stop the automatic payments that will occur before the switch date and maybe add a few days of padding. Total up all the funds that will be paid out from the direct withdrawals, the online bill pay and any checks that will still be outstanding.

- Go to the new checking account and setup the automatic bill payments for all the payments that were just cancelled.

- Leave enough cash in the current checking account to cover all the outstanding bills that are expected to flow through it, plus a little padding.

- Most banks have the ability to transfer between institutions. Setup links between both accounts. This will help transfer the money out of the old account once all the bills clear, and it will also help if money needs to be transferred between them if something gets out of whack.

- Close the old checking account once all the activity has stopped on the old account. It's a good idea to give it a couple of weeks for all things to clear. Most banks require going to the physical branch to close an account. If the bank has assessed extra fees during the transition period be sure to ask them to waive the fees. My account had a few months of fees waived when I closed it.

List of Steps to Switch Checking Accounts

Check

| Item

|

|---|---|

Decide what features are needed in a checking account service

| |

Open a new checking account

| |

Activate all services in the new account (atm card, order checks, mobile deposits)

| |

Switch items on direct deposit to new account

| |

Set date when direct deposits will hit new account

| |

Make list of bills on direct debit from current checking account

| |

Switch the direct debit bills to the new account schedule after direct deposit date

| |

Cancel automatic bill pay from current account for all bills after switch date

| |

Total up all outstanding bills to be paid out of current account and ensure balance

| |

Set up automatic payments in new accounts for bills after switch date

| |

Setup the ability to transfer cash between new and old accounts online

| |

Set reminder to close account approximately two weeks after switch date

| |

Go to bank and close old account

|